But a calculator can help you create a goal to start with.įor example, let’s say your employer offers a 401(k).

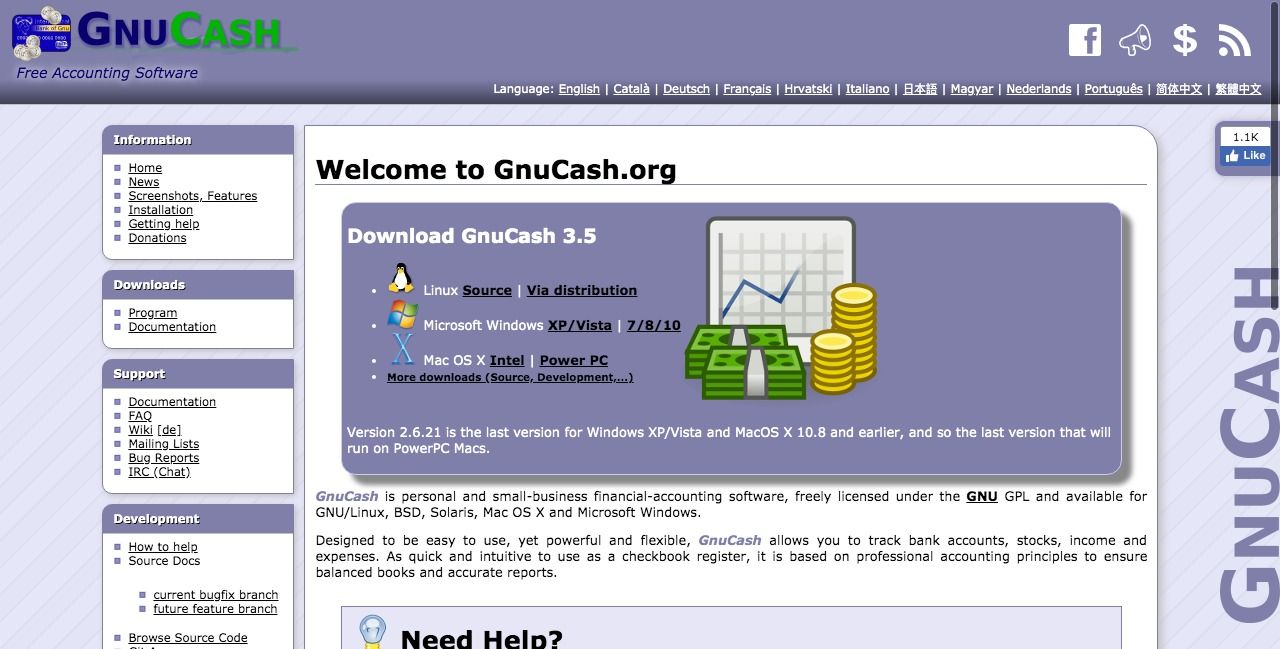

Investorama free financial software software#

Something like the Personal Capital software will help you track what your doing and get projections.

The advantage to using these is that you can find tools and calculators to answer more specific financial questions. Free Retirement and Tax CalculatorsĪnother free way to manage your finances is through the use of online tools and calculators.

However, the free software is robust and will be enough for the average DIY investor to monitor and plan their personal finances. You will get more if you use a paid plan. Naturally, a free account will not give you access to all of Personal Capital’s financial planning software. You cannot buy or sell securities through your linked accounts, but you can see what’s performing well, what isn’t doing so well and how your investments project for the future. If you have investment accounts (even if you don’t invest through Personal Capital) you can link them all and monitor them through the Personal Capital Dashboard. That software includes tools to calculate your net worth, manage your cash flow and analyze your spending. However, creating an account with Personal Capital is free and it gives you access to a host of free financial planning software. Those are high fees by robo-advisor standards and favor people with millions of dollars to invest. With a paid account, Personal Capital will manage your investments for a fee of 0.89% on the first $1 million, down to a fee of 0.49% if you invest over $10 million. Personal Capital is a robo-advisor that serves two distinct sets of clients: people with millions of dollars to invest and DIY investors who want access to free financial tools. If you want help with financial planning but you don’t want to pay, consider a free account with Personal Capital. Free Financial Planning Software: Personal Capital Most robo-advisors have management fees of 0.50% or less. There are usually very few or no human financial advisors on staff and that allows robo-advisors to charge lower fees. You create an account, move money into the account and then the robo-advisor handles everything else digitally. Unlike a traditional advisor, a robo-advisor is completely online. Recent years have seen the rise of robo-advisors. (Just as an example, if you have $100,000 in assets under management and your advisor charges you a fee of 2%, you would pay a fee of $2,000.)

The management fee for a traditional financial advisor is usually between 1% and 2%, but it could easily go higher. In this case, you would most likely pay the advisor a percentage fee based on the assets in your portfolio. More commonly, people work with a financial advisor to create and manage an investment portfolio. For example, you may pay a one-time consultation fee if you need help creating a financial plan, but then you plan to handle your finances on your own. The cost of a financial advisor will depend on what kind of advisor you work with and which services you use. Regardless of your situation, working with a financial advisor can help you to achieve your personal financial goals. That could include general financial planning or advice on a very specific tax loophole.

Investorama free financial software how to#

First of all, a financial advisor is a professional who advises clients on how to best manage their finances.

0 kommentar(er)

0 kommentar(er)